Market Outlook

May 23, 2018

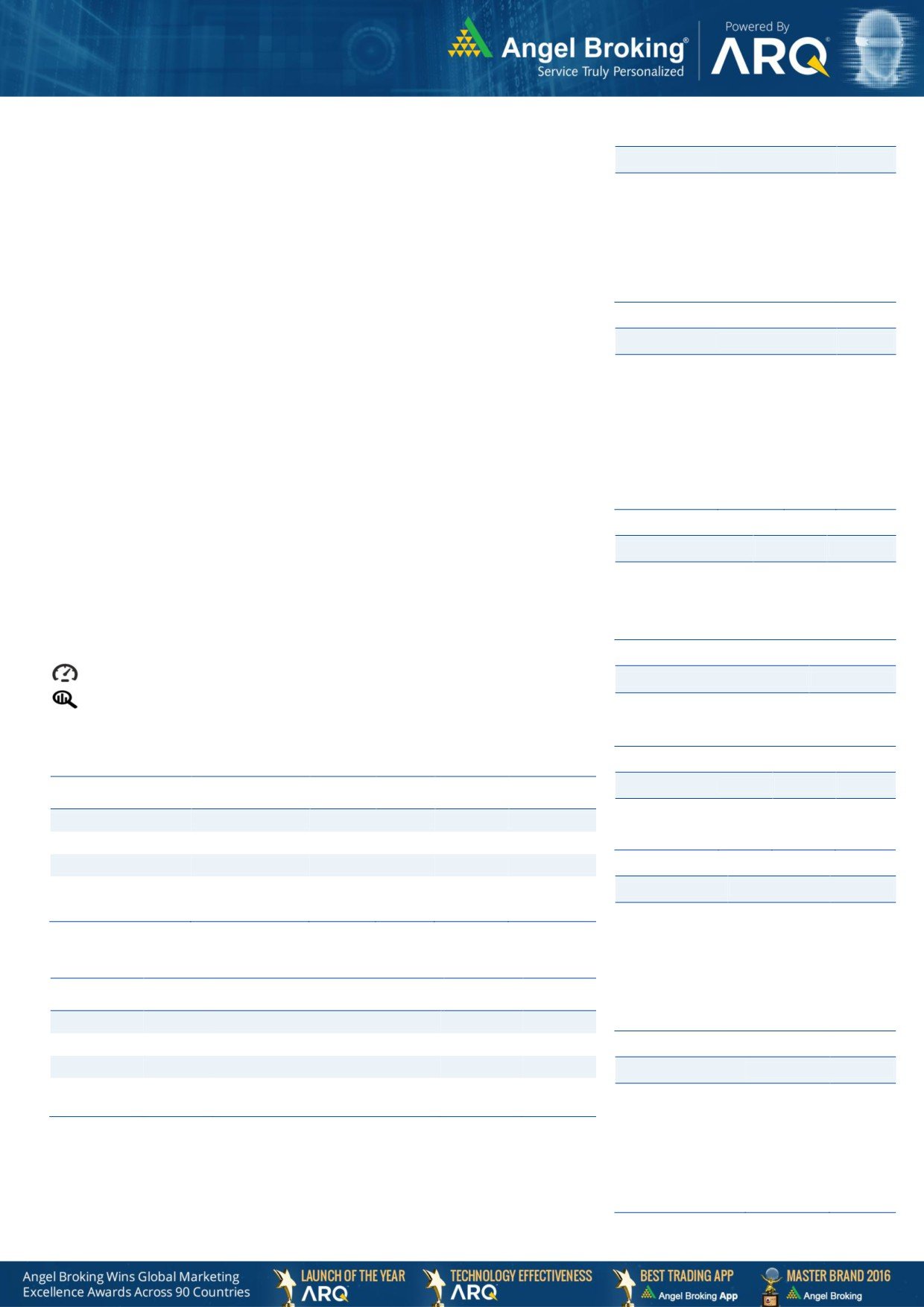

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open negative tracking global indices and SGX Nifty.

BSE Sensex

0.1

35

34,651

U.S. Stocks fell on Tuesday, unable to sustain positive momentum from the previous

Nifty

0.2

20

10,537

session despite overtures from China. China will cut the import tariffs it charges on

Mid Cap

0.7

102

15,738

cars to 15%, which will give a boost to foreign automakers in the world's largest

Small Cap

0.7

111

17,057

market, especially for US automakers. The Dow Jones was down by 0.7% to 24,834

and the Nasdaq closed down by 0.2% to 7,378.

Bankex

0.3

73

28,924

U.K. stocks were modestly higher on Tuesday after a government report showed the

Global Indices

Chg (%)

(Pts)

(Close)

U.K. budget deficit narrowed in April to its lowest level since 2008. Underlying

sentiment remained cautious ahead of the testimony of the Bank of England

Dow Jones

(0.7)

179

24,834

governor Mark Carney to the House of Commons' Treasury Select Committee on the

Nasdaq

(0.2)

16

7,378

latest quarterly inflation report.. The FTSE 100 was up by 0.2% to end at 7,877.

FTSE

0.2

18

7,877

On domestic front, Indian sharesgave up earlier gains to end largely unchanged on

Nikkei

(0.2)

(42)

22,960

Tuesday, tracking mixed global cues. Automakers closed broadly higher after a

Hang Seng

0.6

186

31,234

Bloomberg report that China will cut import duty on passenger cars to 15%.The BSE

Shanghai Com

0.0

1

3,214

Sensex ended largely unchanged at 0.1% to 34,651.

Advances / Declines

BSE

NSE

News Analysis

Advances

1,418

355

After two early Budgets, capital expenditure rises 48% in April

Declines

1,223

1,469

Detailed analysis on Pg2

Unchanged

140

60

Investor’s Ready Reckoner

Key Domestic & Global Indicators

Volumes (` Cr)

Stock Watch: Latest investment recommendations on 150+ stocks

BSE

2,963

Refer Pg5 onwards

NSE

30,180

Top Picks

CMP

Target

Upside

Net Inflows (` Cr)

Net

Mtd

Ytd

Company

Sector

Rating

(`)

(`)

(%)

FII

(100)

(4,952)

8,655

Blue Star

Capital Goods

Buy

707

867

22.6

*MFs

409

8,173

42,632

Dewan Housing Finance

Financials

Buy

608

720

18.5

Parag Milk Food

Others

Buy

323

400

23.8

Navkar Corporation

Others

Buy

154

265

72.3

Top Gainers

Price (`)

Chg (%)

KEI Industries

Capital Goods Accumulate

458

485

5.9

STAR

392

15.0

More Top Picks on Pg4

PCJEWELLER

191

14.9

Key Upcoming Events

BALRAMCHIN

73

11.3

Previous

Consensus

Date

Region

Event Description

NCC

107

9.5

ReadingExpectations

May 23, 2018 Germany PMI Services

53.00

53.00

JPASSOCIAT

16

9.2

May 23, 2018 Euro Zone Euro-Zone Consumer Confidence

0.40

0.40

May 23, 2018 Germany PMI Manufacturing

58.10

57.90

Top Losers

Price (`)

Chg (%)

May 23, 2018 US

New home sales

694.00

679.00

SYMPHONY

1451

-11.2

May 23, 2018 Germany

GDP nsa (YoY)

1.60

1.60

More Events on Pg7

MGL

790

-6.1

EROSMEDIA

122

-4.5

PNBHOUSING

1204

-4.4

JKTYRE

136

-3.5

As on May 22, 2018

Market Outlook

May 23, 2018

News Analysis

After two early Budgets, capital expenditure rises 48% in April

The central government’s capital expenditure (capex) in April 2018 saw a jump of

48 per cent, compared with the same month last year, the consequence of a

second consecutive year of an advanced Budget. The biggest gainers as a result of

this capex boost were the Ministries of Defence, Railways, and Road Transport.

Capex for the first month of 2018-19 was around Rs 430 billion, compared with

nearly Rs 290 billion in April 2017. Overall expenditure, however, dropped from

Rs 2.42 trillion to Rs 2.31 trillion.

Lower carryovers led to a reduced revenue expenditure outlay for the central

government. For April, it was around Rs 1.87 trillion, around Rs 260 billion or 14

per cent lower than Rs 2.13 trillion in April 2017. The official expenditure, revenue,

and fiscal deficit data for April 2018 will be released on May 31. The capex outlay

for the defence ministry jumped a staggering 127 per cent to Rs 148 billion, from

Rs 65 billion for the same period last year, sources said. Railways saw a capex

increase of Rs 20 billion, while the Ministry of Road Transport and Highways was

allocated Rs 70 billion in capital spending, compared to April last year.

Economic and Political News

SBI to sell stake in SBI Gen, SBI Card and SBI Capital soon

Nipah virus may dent India's fruit exports

Odisha plans steel downstream park at Kalinganagar, Tatas keen to invest

Modi, Putin talk multi-nation trade corridor being built by India via Iran

Corporate News

State Bank of India posts record loss of Rs 77 bn in Q4;

Munjal-Burman combine open to idea of rebid for Fortis Healthcare

NCLAT orders status quo on Essar Steel insolvency for two months

Softbank to sell 'entire stake' in Flipkart to Walmart for about $4 billion

Dalmia Bharat won't revise offer, will move NCLAT if UltraTech plan okayed

CCI approves Bayer's $62.5 bn acquisition for US seed major Monsanto

Market Outlook

May 23, 2018

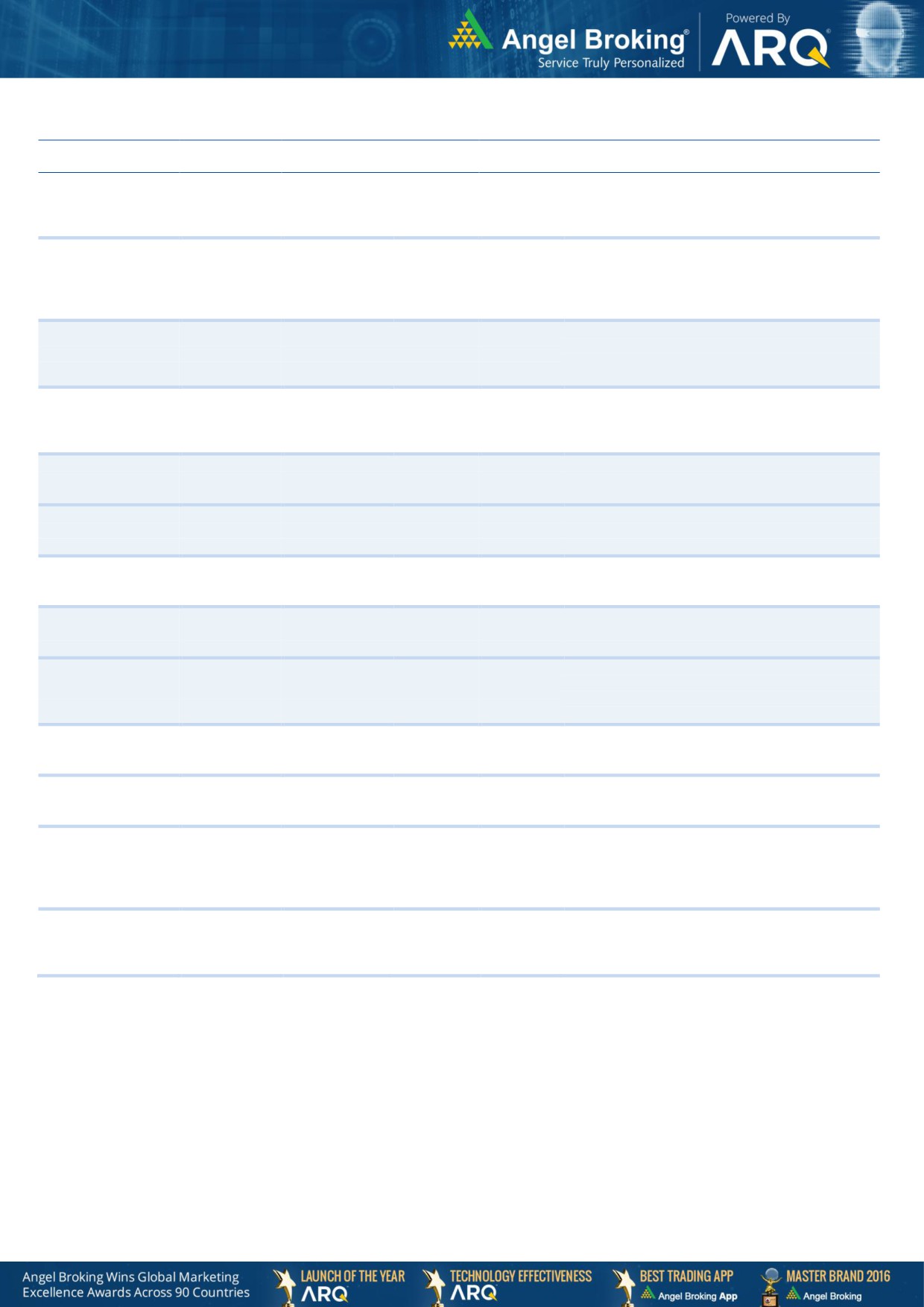

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its

leadership in acute therapeutic segment. Alkem

Alkem Laboratories

22,959

1,920

2,441

27.1

expects to launch more products in USA, which

bodes for its international business.

Favorable outlook for the AC industry to augur well

for Cooling products business which is out pacing

Blue Star

6,787

707

867

22.6

the market growth. EMPPAC division's profitability

to improve once operating environment turns

around.

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

19,059

608

720

18.5

presence in tier-II & III cities where the growth

opportunity is immense.

Well capitalized with CAR of 18.1% which gives

sufficient room to grow asset base. Faster resolution

ICICI Bank

186,926

291

416

43.1

of NPA would reduce provision cost, which would

help to report better ROE.

High order book execution in EPC segment, rising

KEI Industries

3,587

458

485

5.9

B2C sales and higher exports to boost the revenues

and profitability

Expected to benefit from the lower capex

Music Broadcast Limited

1,922

337

475

41.0

requirement and 15 year long radio broadcast

licensing.

Massive capacity expansion along with rail

Navkar Corporation

2,315

154

265

72.3

advantage at ICD as well CFS augur well for the

company

Strong brands and distribution network would boost

Siyaram Silk Mills

2,860

610

851

39.4

growth going ahead. Stock currently trades at an

inexpensive valuation.

After GST, the company is expected to see higher

volumes along with improving product mix. The

Maruti

258,562

8,559

10,619

24.1

Gujarat plant will also enable higher operating

leverage which will be margin accretive.

We expect loan book to grow at 24.3% over next

GIC Housing

2,083

387

655

69.3

two year; change in borrowing mix will help in NIM

improvement

We expect sales/PAT to grow at 13.5%/20% over

LT Foods

2,690

84

128

52.2

next two years on the back of strong distribution

network & addition of new products in portfolio.

Third largest brand play in luggage segment

Increased product offerings and improving

Safari Industries

1,423

640

750

17.2

distribution network is leading to strong growth in

business. Likely to post robust growth for next 3-4

years

We expect HSIL to report PAT CAGR of ~15% over

FY2017-20E owing to better improvement in

HSIL Ltd

2,634

364

510

40.0

operating margin due price hike in container glass

segment, turnaround in consumer business.

Source: Company, Angel Research

Market Outlook

May 23, 2018

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

We expect financialisation of savings and

Aditya Birla Capital

32000

145

230

58.6

increasing penetration in Insurance & Mutual fund

would ensure steady growth.

One of the leading Indian dairy products

companies in India created strong brands in dairy

products. Rising revenue share of high-margin

Parag Milk Foods

2,720

323

400

23.8

Value Added Products and reduction in interest cost

is likely to boost margins and earnings in next few

years.

We expect MCL to report net revenue CAGR of

~15% to ~`450cr over FY2018-20E mainly due to

strong growth in online matchmaking & marriage

Matrimony.com Ltd

1,780

783

1,016

29.8

related services. On the bottom-line front, we

expect a CAGR of ~28% to `82cr over the same

period on the back margin improvement.

Source: Company, Angel Research

Market Outlook

May 23, 2018

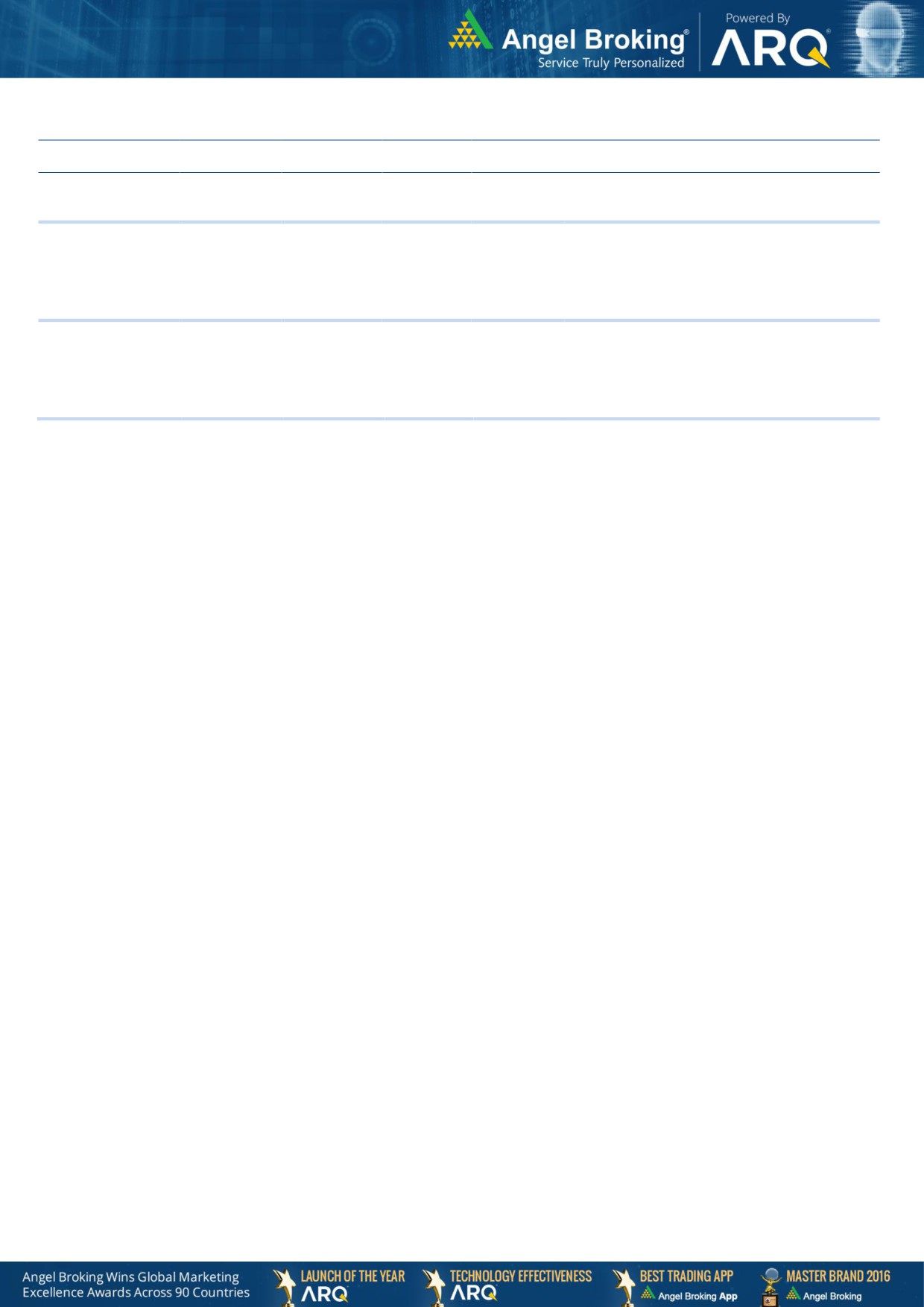

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth trajectory

CCL Products

3,986

300

360

20.1

over FY18-20 backed by capacity expansion and

new geographical foray

We forecast Nilkamal to report top-line CAGR of

~9% to `2,635cr over FY17-20E on the back of

Nilkamal

2,489

1,668

2,178

30.6

healthy demand growth in plastic division. On the

bottom-line front, we estimate

~10% CAGR to

`162cr owing to improvement in volumes.

GMM Pfaudler Limited (GMM) is the Indian market

leader in glass-lined (GL) steel equipment. GMM is

expected to cross CAGR 15%+ in revenue over the

GMM Pfaudler Ltd

1,202

822

920

11.9

next few years mainly led by uptick in demand from

user industries and it is also expecting to increase its

share of non-GL business to 50% by 2020..

Elantas Beck India is the Indian market leader in

liquid insulation segment used in electrical

equipments like motors, transformers etc. It derives

Elantas Beck India Ltd

1,625

2,050

2,500

22.0

demand from several industries which are expected

to register 10%+ CAGR in demand in the coming

years.

Greenply Industries Ltd (GIL) manufactures plywood

& allied products and medium density fibreboards

(MDF). GIL to report net revenue CAGR of ~14% to

Greenply Industries

3,397

277

395

42.6

~`2,478cr over FY2017-20E mainly due to healthy

growth in plywood & lamination business on the

back of strong brand and distribution network

L&T Fin’s new management is on track to achieve

L&T Finance Holding

33,149

166

210

26.5

ROE of 18% by 2020 and recent capital infusion of

`3000cr would support advance growth.

Market Outlook

May 23, 2018

Key Upcoming Events

Result Calendar

Date

Company

Tata Motors, Motherson Sumi, Areva, Ramco Cements, KPIT Cummins, Indraprasth Gas, Bajaj Electrical, Sterling Tools,

May 23, 2018

CESC

May 24, 2018

Cummins India, MOIL, GAIL, GSK Pharma, GIPCL

Source: Bloomberg, Angel Research

Global economic events release calendar

Bloomberg Data

Date

Time

Country

Event Description

Unit

Period

Last Reported

Estimated

May 23, 2018

1:00 PMGermany PMI Services

Value

May P

53.00

53.00

7:30 PMEuro Zone Euro-Zone Consumer Confidence

Value

May A

0.40

0.40

1:00 PMGermany PMI Manufacturing

Value

May P

58.10

57.90

7:30 PMUS

New home sales

Thousands

Apr

694.00

679.00

11:30 AMGermany GDP nsa (YoY)

% Change

1Q F

1.60

1.60

May 24, 2018

2:00 PMUK

CPI (YoY)

% Change

Apr

2.50

2.50

6:00 PMUS

Initial Jobless claims

Thousands

May 19

222.00

220.00

7:30 PMUS

Existing home sales

Million

Apr

5.60

5.55

May 25, 2018

2:00 PMUK

GDP (YoY)

% Change

1Q P

1.20

1.20

May 29, 2018

7:30 PMUS

Consumer Confidence

S.A./ 1985=100 May

128.70

128.00

May 30, 2018

6:00 PMUS

GDP Qoq (Annualised)

% Change

1Q S

2.30

2.30

1:25 PMGermany Unemployment change (000's)

Thousands

May

(7.00)

May 31, 2018

6:30 AMChina

PMI Manufacturing

Value

May

51.40

Jun 01, 2018

6:00 PMUS

Change in Nonfarm payrolls

Thousands

May

164.00

195.00

6:00 PMUS

Unnemployment rate

%

May

3.90

3.90

Source: Bloomberg, Angel Research

Market Outlook

May 23, 2018

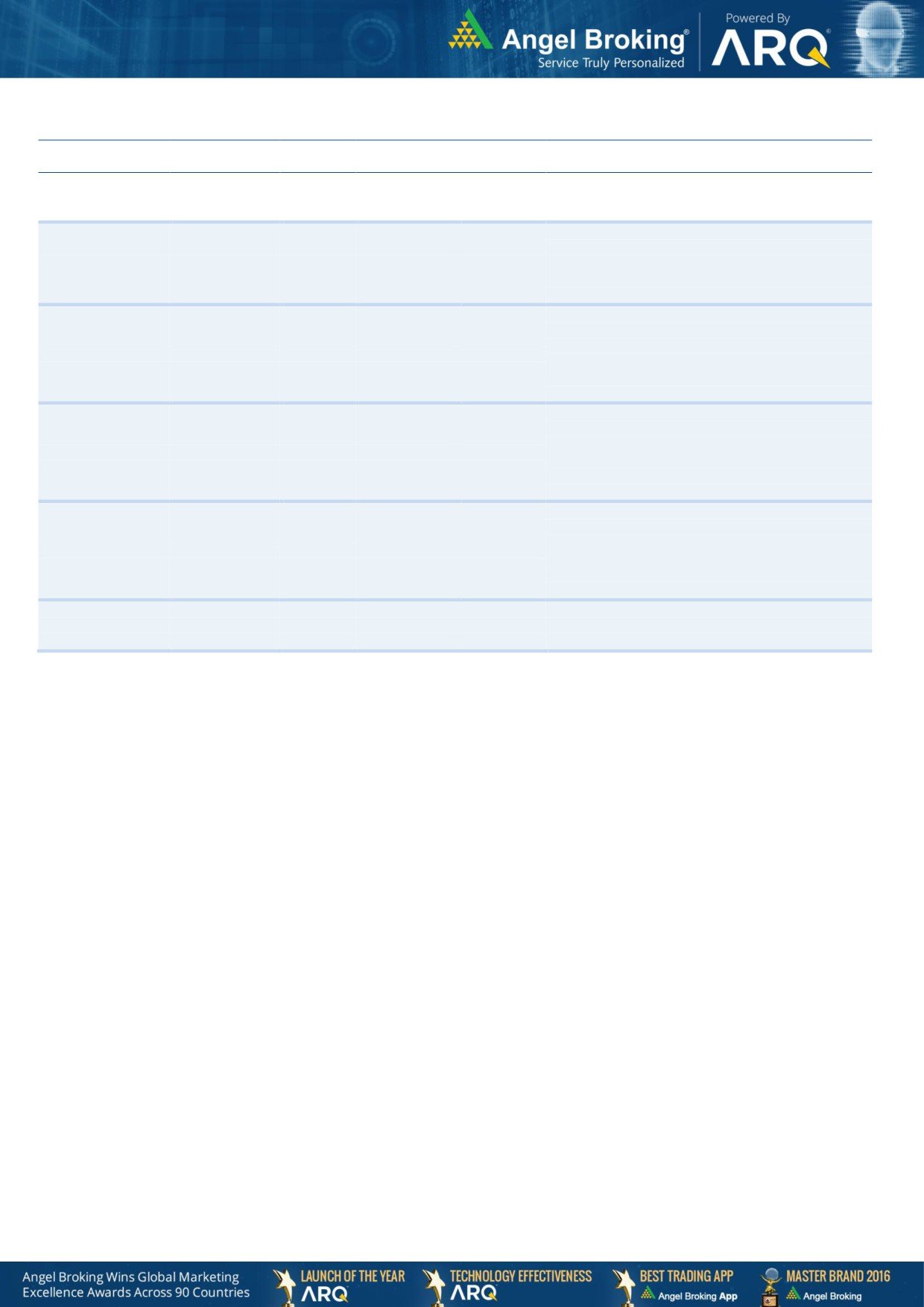

Macro watch

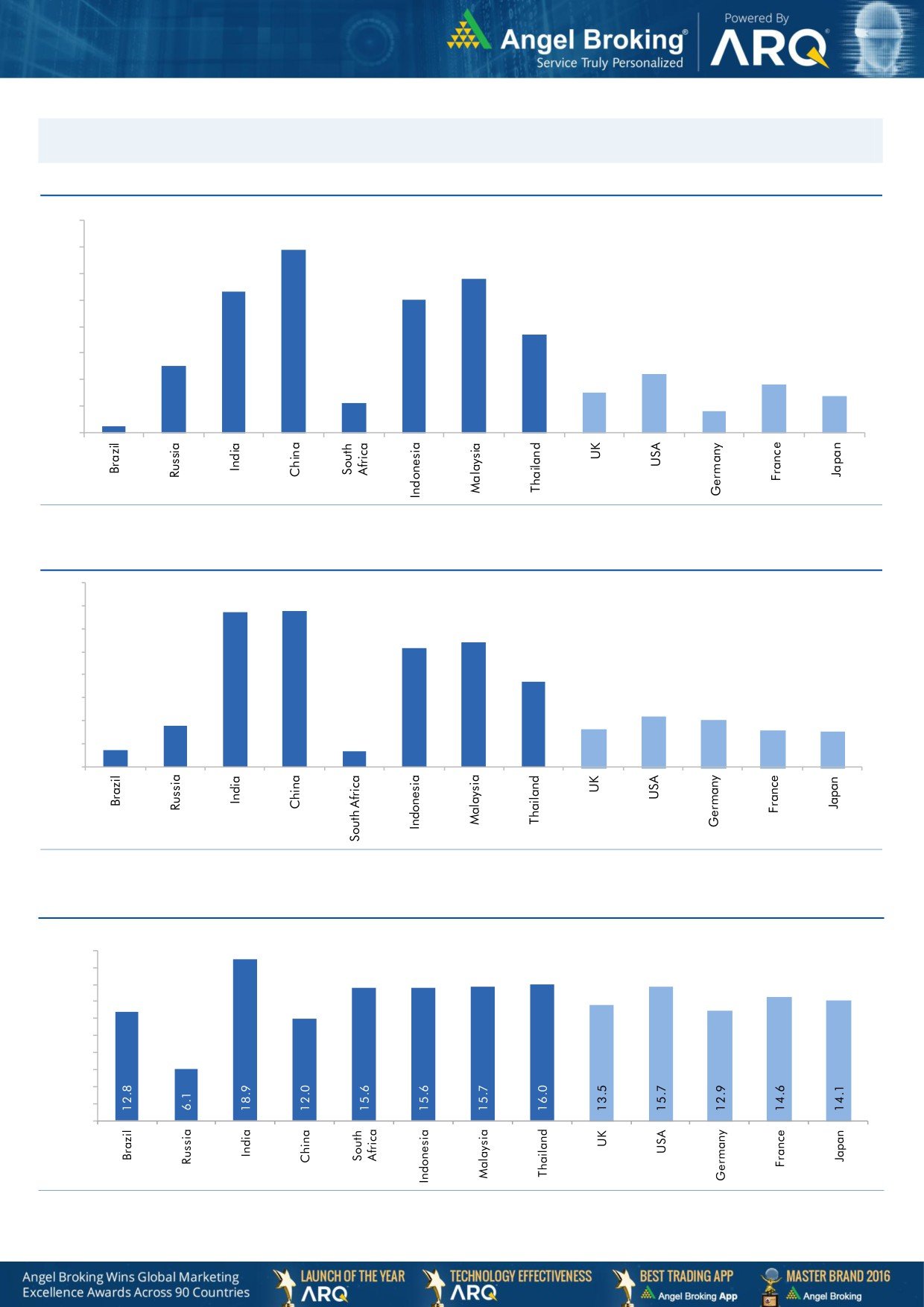

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

8.5

10.0

9.0

9.1

7.3

7.4

9.0

8.0

7.0

8.0

8.1

7.0

7.6

7.6

8.0

7.3

7.2

7.2

6.0

6.8

4.8

7.0

6.5

5.0

4.1

4.4

6.1

5.7

4.0

6.0

2.9

3.0

1.8

5.0

2.0

1.0

4.0

1.0

-

3.0

(1.0)

(0.3)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

6.0

54.0

5.2

5.1

4.9

4.6

52.0

5.0

4.4

4.3

50.0

4.0

3.6

3.3

3.3

48.0

3.0

2.4

2.2

46.0

2.0

1.5

44.0

1.0

42.0

40.0

-

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

35.0

6.50

30.0

6.00

25.0

5.50

20.0

5.00

15.0

4.50

10.0

4.00

5.0

0.0

3.50

(5.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

May 23, 2018

Global watch

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

7.0

5.8

6.0

5.3

5.0

5.0

1.1

3.7

4.0

2.5

3.0

2.2

1.8

2.0

1.5

1.4

0.8

1.0

0.3

-

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

6.7

6.8

7.0

6.0

5.4

5.2

5.0

3.7

4.0

3.0

1.8

2.2

2.0

1.7

1.6

1.5

2.0

0.7

0.7

1.0

-

Source: IMF, Angel Research

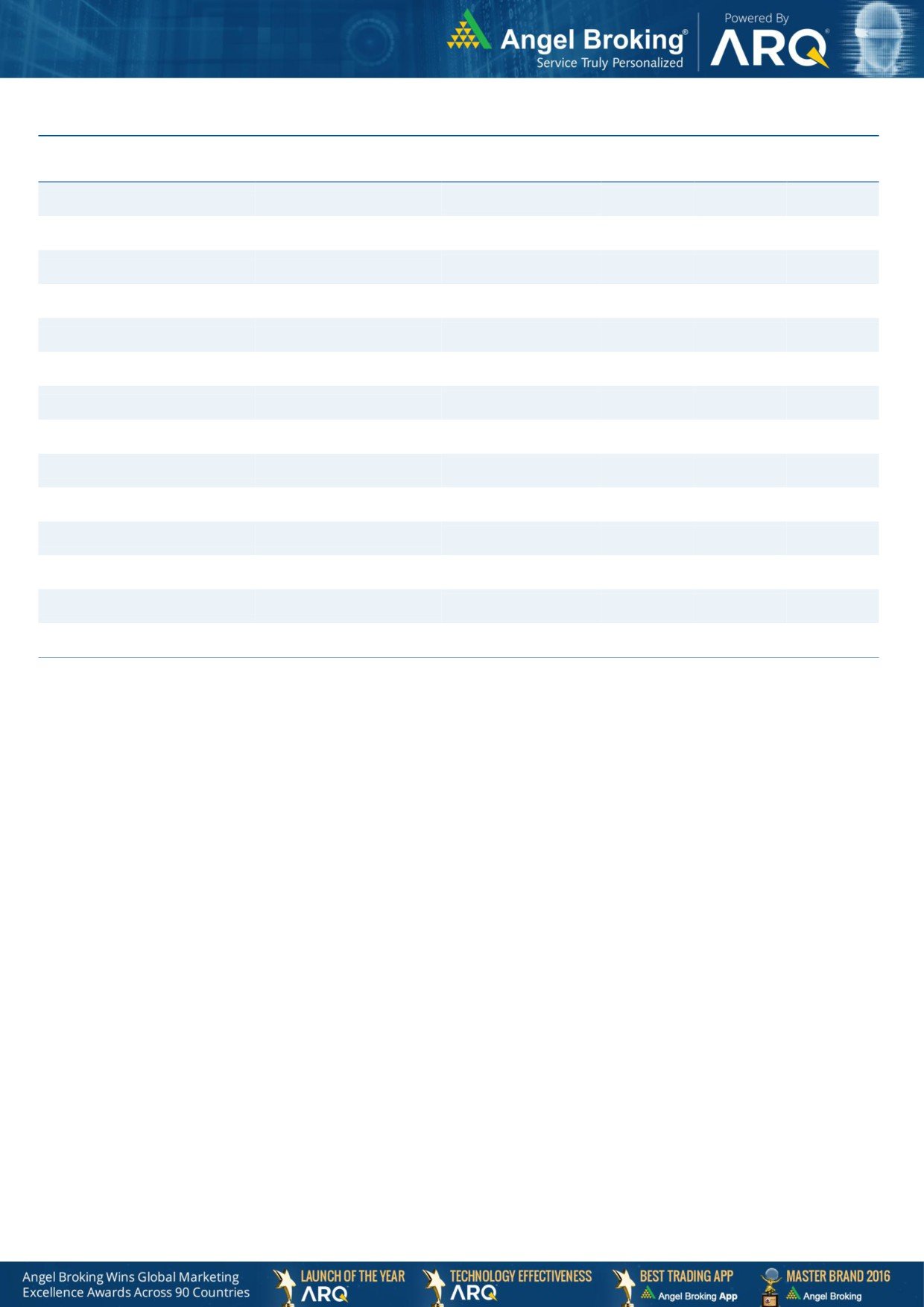

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research as on 22 Mayl, 2018

Market Outlook

May 23, 2018

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

81,815

(4.6)

(3.2)

19.5

Russia

Micex

4,522

1.4

7.1

11.4

India

Nifty

10,517

(0.3)

(0.1)

11.7

China

Shanghai Composite

3,214

4.0

(1.5)

5.0

South Africa

Top 40

51,311

1.1

2.0

7.5

Mexico

Mexbol

45,305

(7.7)

(6.4)

(7.7)

Indonesia

LQ45

907

(11.8)

(17.8)

(3.9)

Malaysia

KLCI

1,854

(0.8)

1.1

4.8

Thailand

SET 50

1,171

(2.0)

0.4

18.8

USA

Dow Jones

25,013

1.4

(0.8)

19.7

UK

FTSE

7,859

7.4

8.6

5.0

Japan

Nikkei

23,002

5.3

8.7

15.7

Germany

DAX

13,078

4.0

6.1

3.8

France

CAC

5,638

4.5

6.6

5.5

Source: Bloomberg, Angel Research as on 22 May, 2018 68in4